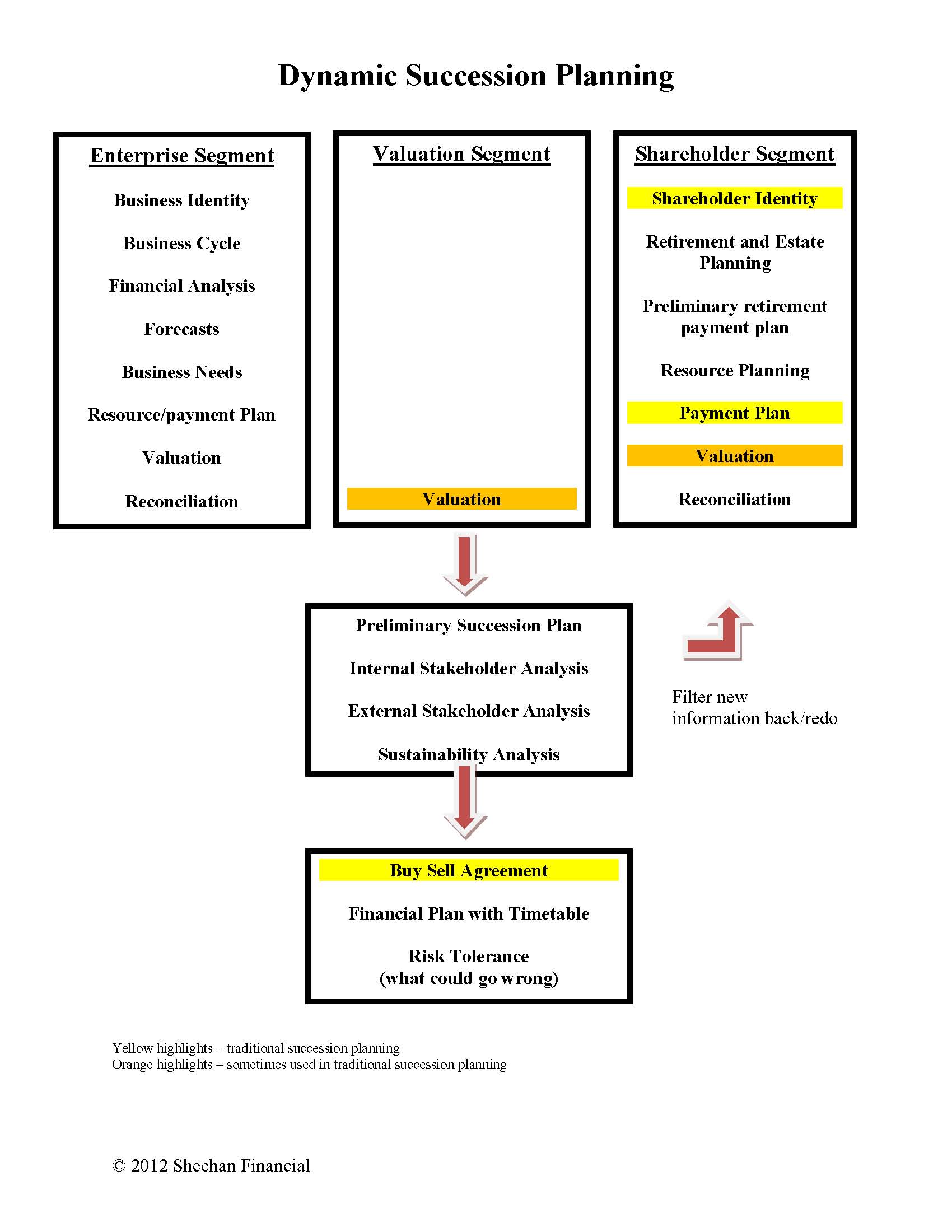

enterprise

This segment focuses on the business and its needs. Only after this is complete can the amount available for a buy out can be determined without negatively impacting operations.

We manage this segment as the financial experts. The steps completed in the Enterprise Segment are:

- Preliminary source of future owner/manager

- Enterprise Identity

- Identity of business cycle

- Complete financial analysis

- Internal and external stakeholder identity

- Business forecasting

- Needs analysis

- Resource plan

- Valuation/Value Model

This phase uses much of the traditional financial analysis both vertical and horizontal. It also includes some specific financial expertise in issues outside of traditional analysis. Most of this analysis involves objective data, but conclusions and recommendations can be and are subjective and rely on extensive finance experience.

In today’s succession planning world, this is the forgotten piece of the success puzzle. If any succession plan, and for that matter, the business itself is to survive, it must have this segment done in detail.

Why is enterprise identity and business cycle identity important? The needs of the enterprise for a growing business is different than an enterprise that is for a lifestyle business. Identifying new management that fashions the enterprise as moderate to fast growing after being a lifestyle enterprise for years can be troublesome for the business long term survival and for the success of a succession plan.

Why worry about stakeholders except shareholders, the only stakeholders currently identified as most important? Current small and mid-sized valuations do not place much emphasis on non-shareholder stakeholders, but they are as critical to business success. These stakeholders are very key to value.

valuation

The valuation segment must be the most objective of any of the segments and follow a number of external guidelines lest it be challenged. Who might challenge a valuation? Certainly the IRS may challenge it as could those who have a financial interest in the ultimate value. A valuation method should be adopted by the board of directors or other governing body of the enterprise. Such a method should come after consulting with CPA and/or tax attorney or attorney specializing in valuation and succession planning. With little exception, this valuation method should be closely adhered to preventing third party challenge or the appearance of changing methods to benefit certain individual(s).

Aside from succession planning, a good valuation will reflect the value of the enterprise as close to market value as possible for a private company. This value will reflect the ongoing decision making and business plan of the company. It becomes an excellent tool to determine the level of success of an enterprise, its management and employees. A valuation must be updated frequently as business conditions change. A formal valuation document should be done every five years, but a company value should be updated every year in the company’s official documents. Alongside this value should be a review of all buy-sell agreements. Everything needs to be done to make sure challenges to the valuation are unsuccessful.

Years ago we actually performed valuations. But since we wish to devote much of our time to the Enterprise Segment and helping guide the Shareholder Segment, we rely on third party valuation sources. While such a valuation can, at times, be time consuming and costly (especially the initial valuation), the enterprise value is independent and less likely to be challenged. The link below is a sample of a valuation.

shareholder

The Shareholder Segment focuses on the shareholder and his/her personal needs. This plan can be developed by the shareholder, but is best done by independent professionals that can provide the needed payment criteria for a buyout.

The steps in the this segment are:

- Preliminary source of future owner/manager

- Shareholder Identity

- Complete financial analysis

- Needs analysis and “what if” testing

- Resource plan

- Business resources required

- Valuation

This segment creates a “value” of the business the owner/shareholder anticipates. For the time being, it is independent to the valuation and enterprise segment; that reconciliation will occur in the next segment. The purpose of this segment is to focus on shareholder need at exit time determining not only the needs (the value amount), but how much of the shareholder value is fixed and how much is variable.

For the shareholder who is totally cashing out at their exit, the strategy will be to increase value knowing the entire amount will be fixed. Most transactions, though, continue an interaction with the exiting shareholder and the enterprise; thus more of the amount of value is variable. Variable means flexibility and improves the likelihood of not only enterprise success, but succession plan success.

With the flexibility of an exit plan comes the expected flexibility on behalf of the enterprise. Just as an enterprise can find added resource needs for many reasons, the shareholder, despite careful planning, can find him or herself with added personal needs and the enterprise can reciprocate. This makes for the ideal plan, rich in value and much safer for all parties.

Customarily, the shareholder uses a personal financial planner or CPA well seasoned in such matters to make their plan. Absent of these professionals, we are able to assist the shareholder in completing this segment. We have a number of tools and worksheets for those who like to “do it themselves”.

tools we use

We all the tools available for your plan, yet some enterprises do not need everything. The uniqueness of an enterprise and its stakeholders will determine what is best. These tools can include: deferred compensation plans, consulting agreements, captive leasing companies, phantom stock, stock appreciation plans, options, preferred stock, life insurance, disability insurance, and trust products to name a few. None are finalized until all parties, including accounting and legal professional review and sign off. None of these are cookie cutter plans, they are as unique to the particular business and its owners.